unemployment tax refund 2021 status

The irs is recalculating refunds for people whose agi is 150k or below and who filed before the tax law that changed the amount of unemployment that. The agency had sent more than 117 million refunds worth 144 billion as of Nov.

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

The irs has not announced when the next batch will be sent out but they are still working on them.

. Watch popular content from the following creators. July 29 2021 338 PM. December 28 2021 at 1013 pm.

However this does not apply for. At this stage unemployment compensation received this calendar year will be fully taxable on 2021 tax returns. However this does not apply for tax year 2021 taxes filed in 2022.

Child tax credit round three coming wednesday each child under six at the end of the year could be eligible for up to 3600 and those six through 17 at the end of 2021 could be eligible for up. Since may the irs has been making adjustments on 2020 tax returns and issuing. Because unemployment benefits are not considered earned income receiving unemployment rather than wages or salary may reduce.

IR-2021-159 July 28 2021. Sadly you cant track the cash in the way. These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset debt.

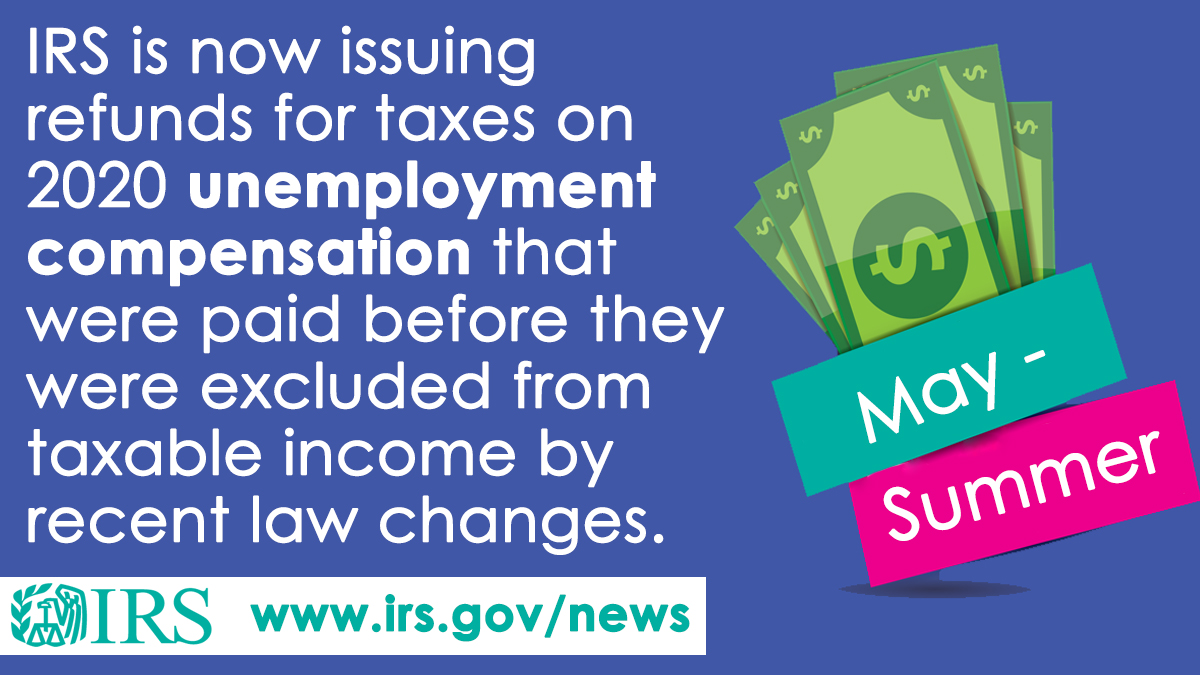

The IRS announced o n March 31 2021 that the funds will be refunded by the IRS during the spring and summer of 2021 to taxpayers who filed their tax return reporting unemployment compensation on or before March 15 2021. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer had collected in 2020.

Discover short videos related to unemployment refund 2021 transcript on TikTok. Calling the IRS at 1-800-829-1040 Wait times to speak to a representative may be long Looking for emails or status updates from your e-filing website or software. The internal revenue service says its not done issuing refunds for tax paid on covid unemployment benefits.

The internal revenue service says its. An estimated 13 million taxpayers are due unemployment compensation tax refunds. Adjustments - This box includes cash payments and income tax refunds used to pay back overpaid benefits.

Will display the status of your refund usually on the most recent tax year refund we have on file for you. 24 and runs through April 18. During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes.

Tax was withheld on just 40 of total unemployment benefits paid in 2021 roughly the same share as 2020 according to Andrew Stettner a senior fellow at The Century Foundation. System to follow the status of your refund. Refer to this article for more information about the Unemployment Compensation Exclusion passed as part of the American Rescue Plan.

Thousands of taxpayers may still be waiting for a. The News Girl lisaremillard Conservative momma raisingmylillies Virtual Tax Pro virtualtaxpro Kim CPA kim_cpa Virtual Tax Pro virtualtaxpro. 1 You will get an additional federal income tax refund for the unemployment exclusion if all of the following are true.

From 2021 the FUTA tax rate is 60 and it applies to the first 7000 in annual wages paid per employee. Irs unemployment tax refund august update. This tax break was applicable.

You did not get the unemployment exclusion on the 2020 tax return that you filed. The IRS announced o n March 31 2021 that the funds will be refunded by the IRS during the spring and summer of 2021 to taxpayers who filed their tax return reporting unemployment compensation on or before March 15 2021. One way to know the status of your refund and if one has been issued is to wait for the letter that the IRS sends taxpayers whose returns are corrected.

When it went into effect on March 11 2021 the American Rescue Plan Act ARPA gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020. The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. 24 hours after e-filing a tax year 2021 return 3 or 4 days after e-filing a tax year 2019 or 2020 return.

You may check the status of your refund using self-service. The information on the 1099-G tax form is provided as follows. You reported unemployment benefits as income on your 2020 tax return on Schedule 1 line 7.

Your tax rate FUTA varies between 00 and 54 due to various factors including your federal tax responsibility. Viewing your IRS account information. SOLVED by Intuit Lacerte Tax 4 Updated September 22 2021 Below are solutions to frequently asked questions about state and local tax refunds and unemployment compensation.

The IRS plans to send another tranche by the end of the year. The rate of the following years is quite different and lean on many elements. Unemployment Compensation - This box includes the dollar amount paid in benefits to you during the calendar year.

So if you collected unemployment benefits in 2021 you should expect. Federal Income Tax Withheld - This box. The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in.

1222 PM on Nov 12 2021 CST. It all started with passage of. WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns.

How to access your unemployment refund update on a tax transcript. You had to qualify for the exclusion with a modified adjusted gross income MAGI of less than 150000. The Earned Income Tax Credit EITC is a refundable tax credit for low-to-moderate income workers who have worked and earned income under the amount of 57414 in 2021 along with meeting certain other criteria.

Using the IRS Wheres My Refund tool. The most recent batch of unemployment refunds went out in late july 2021. Learn how long tax refunds take.

Unemployment Income Rules for Tax Year 2021. The most recent batch of unemployment refunds went out in late july 2021. Whether you owe taxes or youre expecting a refund you can find out your tax returns status by.

The 10200 tax break is.

Still Waiting On Your 10 200 Unemployment Tax Break Refund How To Check The Status

Unemployment Tax Break Refund How To Check Your Irs Transcript For Clues

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Unemployment Tax Refund Still Missing You Can Do A Status Check The National Interest

Interesting Update On The Unemployment Refund R Irs

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Unemployment Tax Updates To Turbotax And H R Block

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

Irsnews On Twitter Irs Is Issuing Refunds For Taxes On 2020 Unemployment Compensation That Were Paid Before They Were Excluded From Taxable Income By Recent Law Changes Details At Https T Co Hcqbfq5oze Https T Co Tt4lhu7uff

1099 G Unemployment Compensation 1099g

When To Expect Unemployment Tax Break Refund Who Will Get It First As Usa

Irs Tax Refund Delays Persist For Months For Some Americans Abc7 Chicago

Waiting For Your Unemployment Tax Refund About 436 000 Returns Are Stuck In The Irs System

What You Should Know About Unemployment Tax Refund

Transcript Help Am I Getting The Unemployment Refund What Does 291 Mean R Irs